Published on 29 March 2023

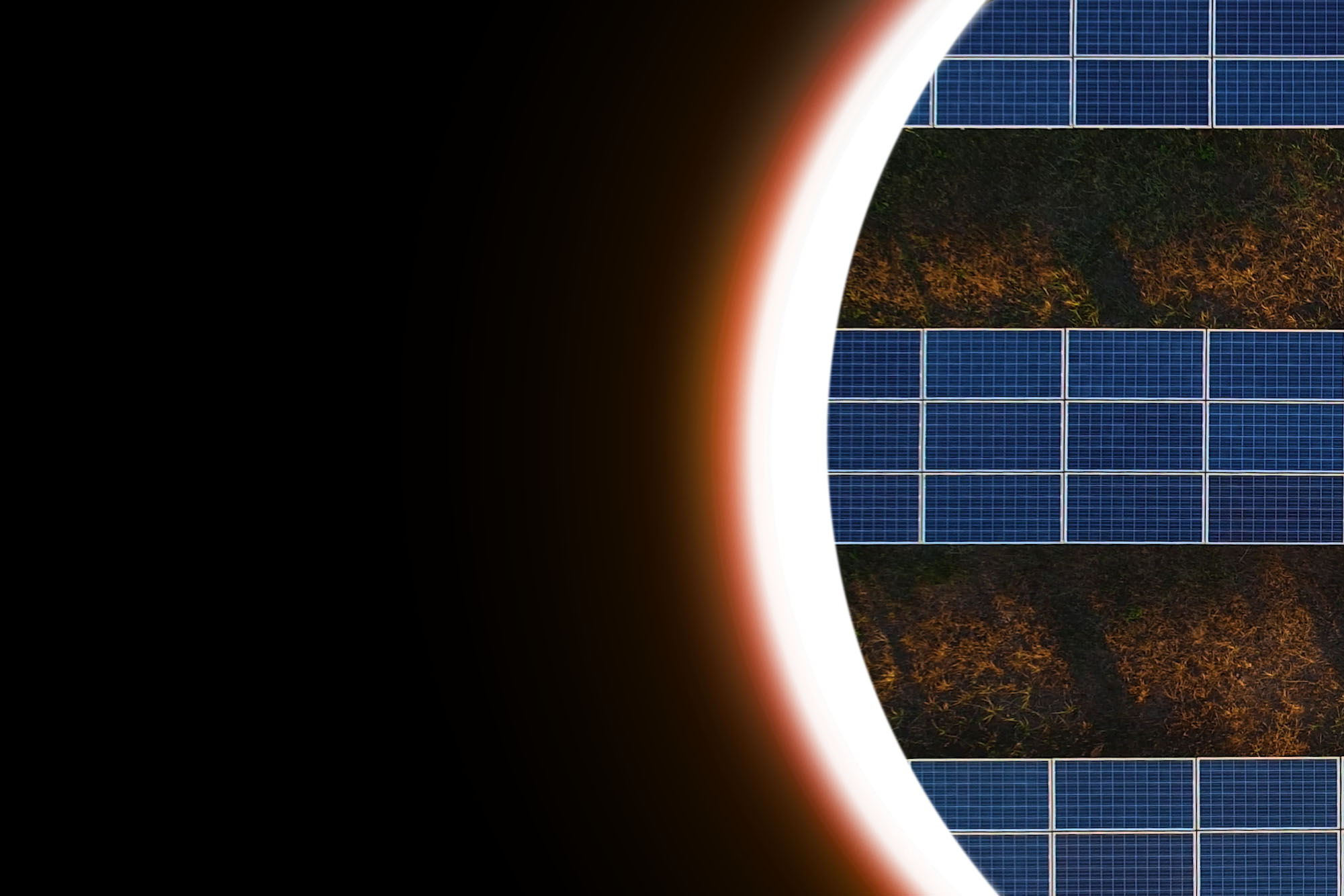

Hail or Shine: The Solar Industry Weathers a Storm

Published on 29 March 2023

Extreme hailstorms are becoming more frequent in mid-US states; last year the US renewables market experienced its worst summer for Nat-Cat claims.

The world is only on the brink of understanding the magnitude of climate change; one part of the complex puzzle is that hail stones are increasing in size, and hailstorm patterns are shifting. In Texas, Colorado and Alabama, records for the largest hailstone have been broken in the last three years – reading up to 16cm in diameter.

Extreme hailstorms are becoming more frequent in mid-US states; last year the US renewables market experienced its worst summer on record for nat-cat claims. Multiple insurance losses have exceeded sub-limits of up to USD50m, driving necessity to seek excess limits due to extreme weather events like hail and tornados. Consequently, catastrophic hail is one of the insurance market’s biggest exposure challenges due to its severity.

The surge in hail and rainstorm losses is a specific concern for solar energy. Some 70% of solar losses in the last 10 years have occurred since 2017. Hail losses last summer resulted in over USD300m in damages – more than twice as severe as other key renewable losses combined over the last three years.

Activity is not limited to the US; hailstorms are becoming more frequent in Europe and Australia; hailstorm records were broken in France in 2022. The European Severe Weather Database revealed the number of hail reports in France up to the end of August 2022 had exceeded the maximum of previous years by a factor of seven.

Given the weight of evidence, it is hard to dispute that hail risks are growing as our planet adapts to climate change. What does this mean for the solar energy industry and the investors and lenders behind it?

Hail testing

Not all hailstones are the same; therefore, it is difficult to measure their potential impact. Hailstones need to be greater or equal to 0.2in to be classed as hail, and the density of a hailstone can determine how large it can grow. Size and weight are not a hailstone’s most important variables – it is the speed it can travel. A large hailstone needs strong updrafts, plenty of super-cooled liquid water and significant time spent travelling around in cold air – strong super-cell thunderstorms possess all these elements.

Most solar panels are tested to withstand 24.4-44.45mm diameter hail, with an expected speed of 25-40 mph. The International Electro-technical Commission’s (IEC) minimum impact test is deemed easy to pass – a 25mm ice ball is shot at the module in 11 locations at 23 metres per second. The module will pass if the glass doesn’t break and power input doesn’t drop by more than 5%. However, there can be unknown damage to modules’ solar cells even if the glass appears intact. The modules must pass the wet leakage test but there is no requirement to test for micro-cracking, which can lead to decreased solar production. The projectiles used for testing are half the size of the average hailstone experienced in a very severe hailstorm in the US.

The IEC does offer a high-impact test that manufacturers can opt for, but a majority don’t. As a result, manufacturers don’t always establish the maximum ice ball size their modules can withstand, and panels are not necessarily being tested for the growing number of severe hailstorms.

Changing insurance landscape

In 2019 the solar market suffered the largest weather-related single-project loss in its history. Midway, a 178mw solar project in Pecos County, Texas, was hit by a severe hailstorm which damaged or destroyed 400,000 of the plant’s 685,000 modules; the insurance losses totalled USD85m.

The unprecedented loss prompted industry reflection on exposure; what followed was a constriction in capacity and rate rises, terms and conditions for microcracking, deductible changes and hail limits, as well as a CNA Hardy market exit.

Consequently, the market hardened – insurance rates increased by around 20%-50% for convective storm damage, but in some unique cases jumped as much as 400% over 18 months. It left a lasting legacy: insuring solar panels against hail damage is now more expensive and granular, with reduced sub-limits for hail cover.

Due to a hard market for solar and hail, local appetite has reduced, especially in the US, due to recent hail activity. While capacity remains, some fine tuning is necessary to marry carrier appetite to client requirements.

Risk management has been forced to mature rapidly, and developers looking to build projects in high risk areas now include risk assessment as part of pre-construction process, with lenders wanting evidence that the risks can be covered before agreeing to finance projects. Developments in solar tech have advanced somewhat in recent years towards improving weather resistance; insurers now expect automated or unified tracker stow-mode capability.

Developers have been focused on cost, but there has been a noticeable shift in direction. Previously, firms in certain nat-cat areas sought panels with the thinnest glass possible to maximise irradiance and generation. Now there is a growing awareness that this approach increases the exposure to extreme hail.

The insurance market is consequently experiencing an adjustment phase, with the approach to nat-cat perils being optimised. This has seen Alesco sourcing innovative stacking solutions of primary sub-limits and excess layers to reach required levels of cover. In addition to the conventional all risks insurers, in which pricing has become variable, a wider pool of carriers is continuously being accessed as new capacity emerges offering specialised products. Parametric carriers now provide specific hail insurance solutions whereby coverage is triggered when a measurable hail storm event occurs that exceeds a predefined threshold. The trigger for coverage and pay-out is determined by the size of the largest hailstone.

As the industry adapts and balances panel performance with extreme weather risk, Alesco can draw upon its access to the London market and provide innovative cover at competitive terms. With early collaboration with clients, we can support with site selection, contract and specification. Our approach begins with development and extends right through to detailed design, including weather risk mitigation, detection, data sources and hail/wind protection. We engage with insurers and explore all existing options, circumnavigating the volatility that comes with relying on one market.

In the longer term, all stakeholders need to help establish a path towards greater certainty of terms and pricing. Data sharing opportunities, underwriting tools for differentiation and owners implementing best practices and hail risk management will all play an important role in the sector’s future.

Duncan Gordon

Duncan joined Alesco at the beginning of 2018, after seven years specialising in construction and operational insurances within the offshore and onshore renewable energy sectors.

He has direct experience of project finance transactions and ensuring that all insurance conditions precedent to financial close are satisfied. The key elements of this service delivery are efficient communication and the ability to coordinate amongst both the international and local placement teams.

Duncan has wide-ranging experience of renewable energy projects throughout the lifecycle and is a skilled practitioner in providing insurance solutions for large and complex assets and portfolios globally. He currently provides guidance and insurance solutions to clients in North America, the Middle East, Europe, Latin America, Australia and the UK.